Anti-Money Laundering (AML) Software

What is Anti-Money Laundering Software?

Solutions provide financial institutions with information on high risk individuals. This is a requirement when conducting a background check for Know Your Customer (KYC) and other compliance standards.

Common Features

- Enforcement and Sanction Watch Lists

- International Data Sources

- Adverse Media

- Minimum Number of Records

- PEP Screening

- Data Curation

- Identity Verification

- Name Matching Technology

- False Positive Remediation

- Risk Assessment

- International Verification

- AI/Machine Learning

- Watchlist Alerts

- Multiple Language Support

Our Methodology

Composite Score

Vendors are ranked by the composite score, which is comprised of feature, capability, relationship, and overall satisfaction scores while factoring in the volume and recency of reviews.

CX Score

The CX score is comprised of the emotional footprint metrics, balanced by metrics related to the overall value of the software, while factoring in the volume and recency of reviews.

Data Quadrant

SoftwareReviews collects user insights that help organizations more effectively choose software that meets their needs, measure business value, and improve selection.

Rankings, results, and positioning on SoftwareReviews reports are based entirely on end-user feedback solicited from a proprietary online survey engine.

Leaders

Products that resonate strongest in the market, balancing features with a great user experience.

Product Innovators

Products that emphasize product features, gaining strong recommendations from their customers.

Service Stars

Products that emphasize a good user experience and build strong relationships with customers.

Challengers

Products that are strong performers in some areas and trail in others. Often up-and-coming vendors.

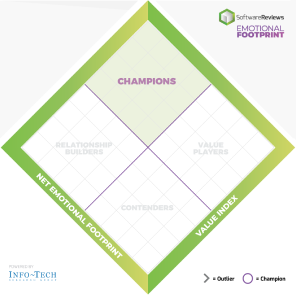

Emotional Footprint

SoftwareReviews collects user insights that help organizations more effectively choose software that meets their needs, measure business value, and improve selection.

Rankings, results, and positioning on SoftwareReviews reports are based entirely on end-user feedback solicited by a proprietary online survey engine.

Champions

Products that resonate highly with users at an emotional level. Users have specific emotional views towards these products like love, trust, and effectiveness.

Relationship Builders

Products that are bulletproof and focus on fulfilling core needs with steady support, not the latest feature.

Value Players

Products that succeed on cost and service effectiveness with users.

Contenders

Products seen as good in some areas and trailing in others. Users look to these for innovation at the edge but aren't fully committed.

Write a Review to receive up to a $10 Gift Card*

*After you complete our short 5-6 minute survey, we will happily provide you with your choice of reward up to $10 based on available options for your region.

Write a ReviewGet Instant Access<br>to this Report

Get Instant Access

to this Report

Unlock your first report with just a business email. Register to access our entire library.

© 2026 SoftwareReviews.com. All rights reserved.